While you still have free time left this summer, it’s a great time to evaluate your finances and consider tackling student loans now rather than later.

Although many college students view repaying their student loans as a daunting responsibility they have to deal with “later,” now is a great time to get a step ahead and alleviate some of the financial burden while you can.

Getting a part time job and paying the interest on your student loans certainly has some benefits. For starters, unsubsidized loans accumulate interest as soon as the loan is disbursed. As your loan accumulates interest, the interest is capitalized and added to the principal balance. This is known as the snowball effect and before you know it, you begin accumulating interest on interest.

Making payments to cover interest on student loans won’t alleviate the largest portions of your loans, but paying now will help you avoid the snowball effect that can add a considerable amount of money to your principal balance.

Here are 3 different ways you can start alleviating the financial burden of student loans.

- Pay more than your minimum payment

If your financial situation allows you to, paying more than your minimum payment is a great way to start getting ahead and minimize your debt for when graduation approaches. If you’re able to pay more than your minimum payment be sure to apply the payment to the loan with the highest interest rate. Loans with higher interest rates grow the fastest, increase your total payment which will ultimately extend the time it will take to repay the loan. - Treat it like a mortgage

Treating your loans like a mortgage and making larger payments will enable you to cut down on your payoff time tremendously. If you work full time and stay at home, it’s wise to put your hard earned money towards your loans now in exchange for financial freedom later. - Establish a college repayment fund

Another great way to tackle student loans is establishing a college repayment fund. Putting away $100-$200 into a savings account or money market account while in school will provide you with a nice sum of money you can rely on once graduation hits and your six-month grace period has ended.

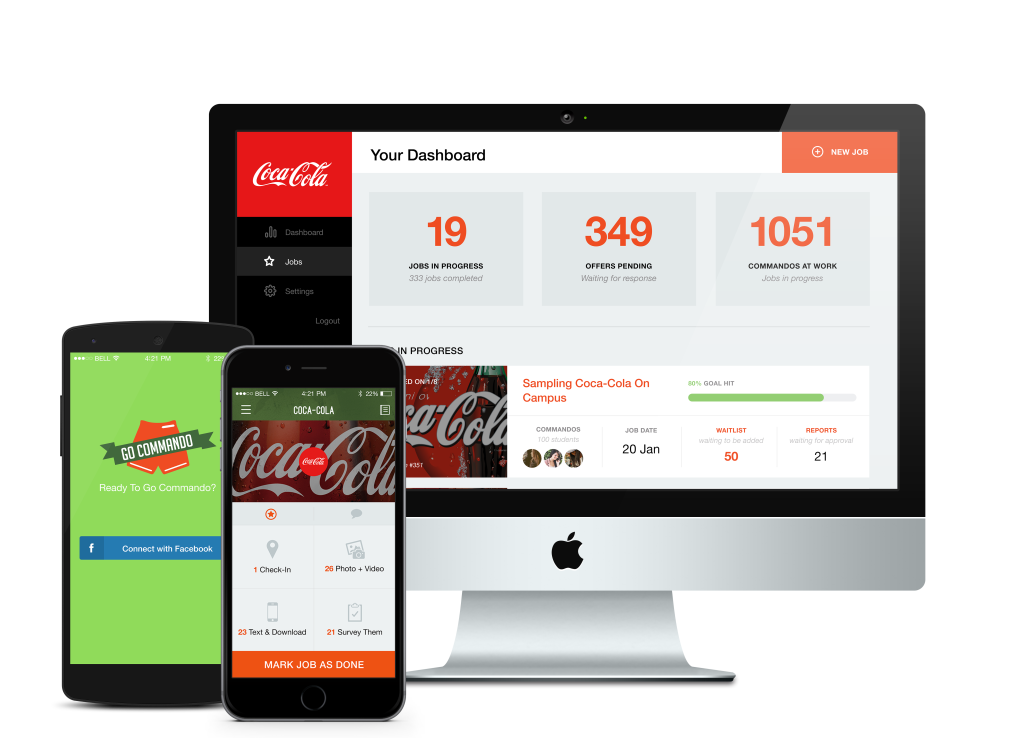

Having a college repayment fund will alleviate stress if you have difficulty finding a job fresh out of college, providing you with a security net.Having a hard time finding a job that suits your schedule? Don’t let that stop you from tackling student debt. You can start earning money with our free Go Commando app available in the App Store or Google Play. We’ll send you notifications as tasks become available. Accept the task, complete it, and get paid.